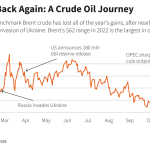

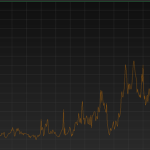

In the ever-volatile world of energy markets, a recent development has sent shockwaves throughout the industry. Cushing oil stocks, a critical indicator of oil market stability, have plummeted to near-historic lows. This sudden turn of events has caught the attention of both investors and analysts alike, leaving many wondering about the implications for the global […]

Read MoreCushing, Oklahoma oil stocks near all-time lows