(BELLE VERNON, PA, SEPTEMBER 16, 2024)—Guttman Holdings, Inc, a 100% employee-owned organization and the parent company of Guttman Energy, Inc., Guttman Renewables, LLC, and Source One Transportation, LLC, announces today that Guttman Energy and Source One Transportation have acquired the assets of Weaver Energy, Inc. of Lititz, PA. Founded in 1995 by Ken and Deb […]

Read MoreThird Major Deal in Energy Sector Announced

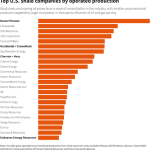

United States shale oil producer CrownRock has agreed to be purchased by Occidental Petroleum in a stock and cash deal valued at $12 billion dollars. CrownRock is a major privately held energy producer that operates in the Permian Basin. This deal expands Occidental Petroleum’s presence in the largest shale oilfield in the United States. The […]

Read MoreXPO to Purchase Yellow Freight Service Centers Totaling $870 Million

In August of 2023, Yellow Freight Service filed for bankruptcy, and the near-100-year-old company ceased all business operations. As the fallout from that continues, 128 of their 169 properties sold for a whopping $1.9 billion. Among the buyers, the most notable is XPO, who is purchasing 28 of Yellow’s locations totaling $870 million. XPO purchasing […]

Read MoreFuel Management Services with Major Operability Solutions

Fuel Management Help for a Heavy Construction Contractor One of the largest earthmoving general contractors in the PA/OH/WV region needed help. This company specializes in construction operations for highway, site development and mining projects, even getting involved in Marcellus shale development. They deal with a lot of sensitive equipment, and reliability or operability issues can […]

Read MoreNew Year, not so New Market

The new year roared in somewhat uneventful in the commodities market. The markets seemed to be finding a stride, finding their way back to fundamentals and technical data while straying from a 2-year pattern of extreme volatility. 2023 seemed like it was going to yield markets that would follow norms, the usual prior to February […]

Read MoreRussia not Crude over Oil Price Cap

With the new $60/BBL oil price cap on Russian oil exports now in place, Russia says it will not impact their production. The move did however create a bottleneck of oil tankers in Turkey as Russian oil tankers significant drop in its oil production or exports.[1] [1] https://www.cnbc.com/2022/12/07/eu-sanctions-russian-oil-price-cap-cause-crude-tanker-bottleneck.html Since the oil price cap, 35 tankers […]

Read MoreDiesel Prices Back to Pre-War Levels

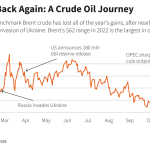

As we near the end of a volatile 2022, who would have thought NYMEX diesel prices would be trading at pre-Russia-Ukraine war levels? The answer is not a lot of people, yet here we are. NYMEX diesel prices are trading at $2.8860/gallon today, right at the levels we were trading at on February 24th when […]

Read MoreIs a Railroad Union Strike Imminent?

Last week, the railroad unions rejected a collective bargaining deal with the freight railroads. Four out of the twelve unions rejected a deal that was brokered by the Biden Administration in mid-September, and now the two sides have until December 8 to iron out a new agreement with a potential strike looming on December 9. […]

Read MoreDiesel Price Premium Hits All-Time High Over Gas, Crude Oil

Reduced refining capacity combined with weather and geopolitical intrigue have eroded diesel stockpiles in the United States to noteworthy lows. Between the years of 2017 and 2021, the U.S. averaged 34 days of distillate supply, compared to just 25 days as of October 2022. Accordingly, while the price of gasoline has increased roughly 14% this […]

Read MoreCrude Oil Crushed

WTI Crude oil prices topped $93.50/barrel on Monday and now trading at $86.21/barrel at writing. Why the significant drop? Let’s look at the fundamentals and the technical for an explanation. From the fundamental perspective, China re-affirmed its stance this week on its zero-COVID policy strategy that when a few cases are confirmed, a lockdown of […]

Read More