Amid expectations of a 3.5 million barrel decline, the surprising build in crude last week had led some analysts to question if OPEC cuts are actually impacting the market. We saw the market react to the large builds on diesel and gas all afternoon yesterday, but today it is trying to regain some ground.

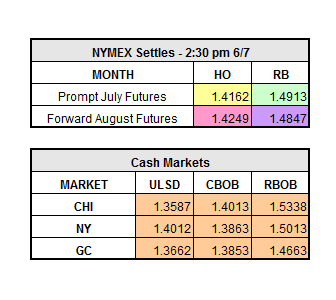

Yesterday WTI Crude closed down $2.47 to $45.72/bbl (about 4-5 percent, a session low), front month HO closed down 5 cents to $1.4162/gal and front month RBOB closed $0.0632 to $1.4913/gal. According to Germany’s Commerzbank, “Unless data are released that make the latest inventory build appear an anomaly, oil prices are hardly likely to make any lasting recovery.” The next question is, will July HO and RBOB hang on to their current support levels or dip down to the next level lows? Yesterday heating oil fell below the support level of $1.4144/gal, and today RBOB fell below its support level of $1.4861/gal. The next technical price levels to watch for are $1.3846/gal for Heat and $1.4543/gal for RBOB. Currently, prices have been bouncing up and down off of the current support levels stated above.

Analysts were still optimistic that cuts will still start to have some affect in the second half of this year. Countering this optimism is Libya, which has increased crude output. Along with Nigeria, Libya is exempt from OPEC cuts. As noted in yesterday’s blog post, Nigerian crude is returning to the market now that Shell has lifted force majeure.

As of 11:25 a.m. ET front month HO is up $0.0074 to $1.4236/gal and front month RBOB is up 20 points to $1.4933/gal.