As everyone woke up to the first punch of winter weather this morning, as a fuel distributor, it certainly makes us think about the low level of diesel inventories in PADD 1 and the potential impact it will have on our customers this winter.

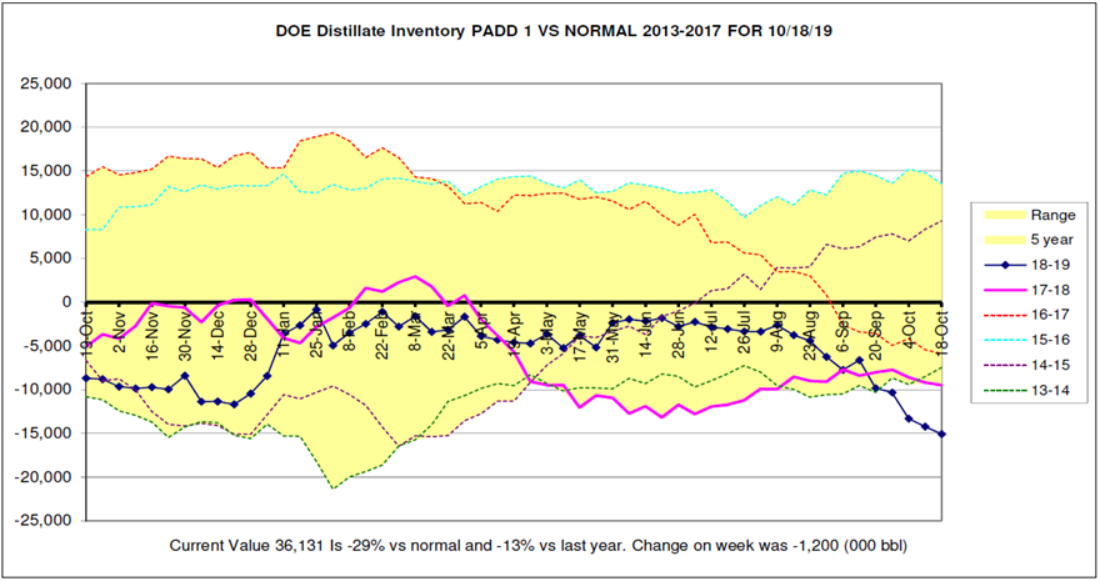

The chart above represents diesel inventory levels in PADD 1 – the inventory area along the East Coast of the United States. Two weeks ago we had 36.1 million barrels of diesel in storage. These levels are 13% lower than last year and 29% lower than the average for this time of year. There are two main components that have led us here.

Firstly, the International Maritime Organization (IMO) 2020 regulation effective January 1st that all international ship traffic must consume fuel of less than 500ppm sulfur content. Previously they could consume up to 3,500 ppm. This attempt to lower sulfur emissions has put a strain on New York Harbor diesel inventories because vessels are prepping for the regulation and loading fuel in PADD 1 as the United States has the most accessibility to the fuel compared to the rest of the world.

Secondly, the closure of the Philadelphia Energy Solutions 335,000 barrel per day refinery this summer is starting to cause some pain. In the aftermath of the closure in the summer, importers and Gulf Coast product was quick to fill the void so locational prices were able to stay in check. However, with the increased demand in the New York Harbor for diesel fuel and the fact that the Gulf Coast can ship only so much on the pipeline, the New York Harbor is lacking the ability to bring imports in fast enough to get inventory levels back to normal.

With all this being said, the next few months with regard to New York Harbor diesel demand in PADD 1 will be interesting – especially if we have a cold winter. Consumers might be impacted by paying marginally higher prices than they seasonally pay in order to offset the higher priced imports that might be necessary for us to have adequate inventory levels. The December heating oil crack spread, used to determine the heating oil price vs crude oil in barrels, has risen almost $5/barrel since August – meaning that diesel prices have risen about 12.5 cents per gallon in relation to crude oil already.

December WTI crude oil is trading higher today by $1.03 to $55.21/barrel, heating is up by $0.0377 to $1.9135/gallon, and gasoline is up by $0.0402 to $1.6348/gallon.