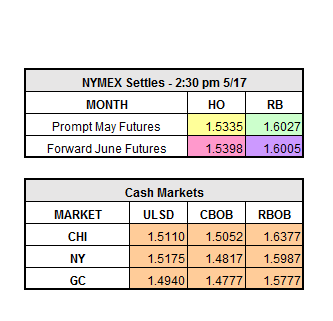

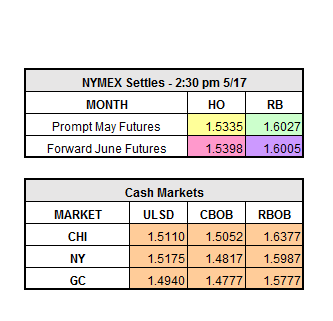

The market was down over 2 cents early this morning, made its way back to flat, and is now trading up across the board. Yesterday, front month HO closed up $0.0171 to $1.5335 and front month RBOB closed down $0.0016 to $1.6027.

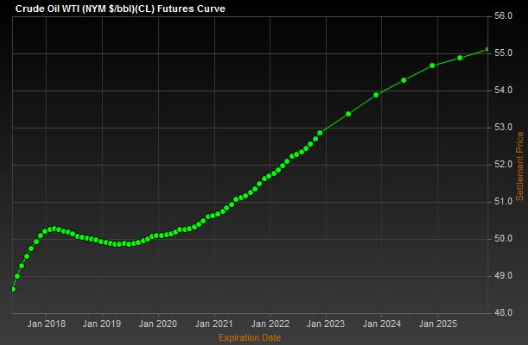

Current news has been predicting that OPEC is leaning towards extending production cuts more and more every day. The United States is not making it easy for OPEC though, by continuing to increase output and offsetting what OPEC is cutting. Also joining in on the fun are Canada and Brazil who are ranked the 7th and 10th largest oil suppliers; both are producing at record highs this year, adding to the uneasiness of OPEC. All of this additional production will make it very difficult to balance out oil supply and demand. Oil prices have significantly dropped over the past three years, but balancing supply vs. demand inventories has been a slow process, and with all of the extra product it may not speed up anytime soon. Looking at the big picture, it seems OPEC’s goal is to get oil prices to be cheaper in the future rather than in the present day (aka backwardation). The chart below shows the exact opposite. Oil prices have been sitting at a range of $44-55 a barrel.

Pay close attention to the news next Thursday, as OPEC meets to make a firm decision about the 6-9 month extension of production cuts. Currently, as of 11:47 a.m. ET, June HO is up $0.0150 to $1.5485 and June RBOB is up $0.0095 to $1.6122.