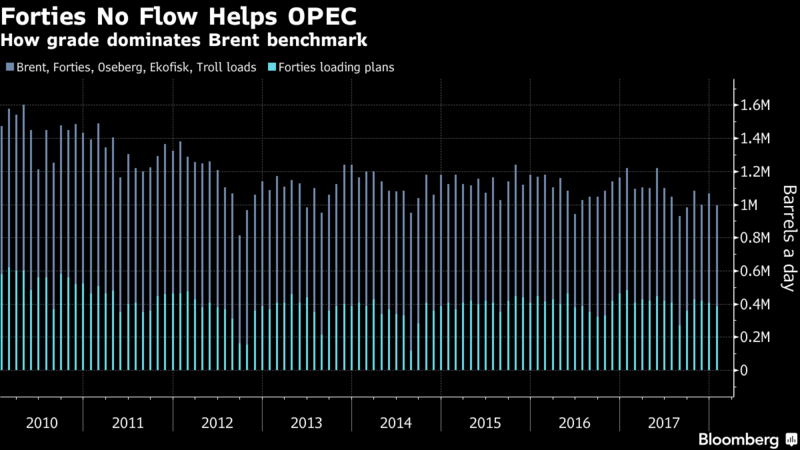

The big story this week is North Sea Forties Pipeline System halt for maintenance. The pipeline supplies 40% of UK crude supply and supported the Brent/WTI price spread.

12/12 trading saw 2017 highs achieved for Crude and diesel NYMEX contracts until profit taking amid the EIA monthly outlook of crude production at 9.7 million b/d pushed prices lower. How oversupplied is the US market? 9.7 million b/d is the highest production figure sine 1970!

The above news overshadows colder than normal temps much of the US. Heating Oil dealers report excellent demand and we see that in lifting’s throughout our system.

Unfortunately, the forecast for the third week of December is milder than normal temps for much of the US.

Where will price go from here? How long will the Forties Pipeline be down? Will US production continue to rise? Will OPEC producers stay committed to production cuts in the face of higher prices?

This all leads to price uncertainty and volatility. Talk to us about how to manage this volatility.