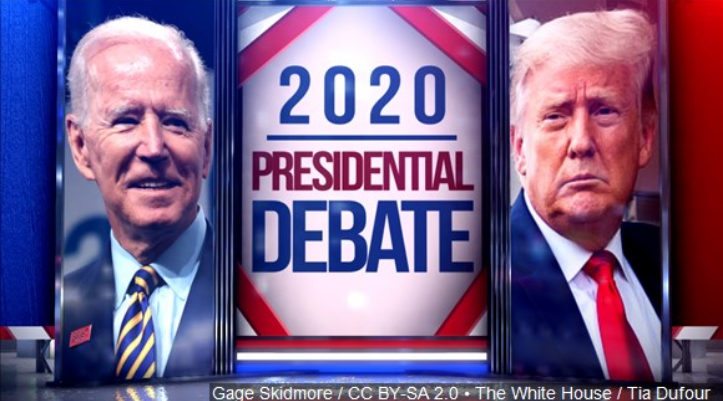

Last night marked the first presidential debate of 2020, and it was interesting to say the least. 69% of people in a CBS poll said they were “annoyed with the event”. During the debate both candidates threw insults and repeatedly interrupted each other while Chris Wallace tried to control the conversation.

One day after the debate US futures fell, alongside most stock markets. Chris Weston, the head of research at Pepperstone Group Ltd said, “What we’ve seen from the debate is the reinforcement that if Biden wins, Trump is not going to accept that.”

Investment firms also re-positioned on the final day of the third quarter, and tech shares fell in premarket trading. Disney, with one of the largest workforce reductions during the pandemic, is about to lay off 28,000 workers from their operations.

Shell has plans to cut 7,000 to 9,000 jobs by the end of 2022 in order to save as much as $2.5 billion to move towards clean energy. It also has plans to refocus its refining business by reducing the number of plants from 15 to fewer than 10.

Oil prices fell for a second day this week, as rising coronavirus cases cause for concerns about further restrictions on global economic activity that could curb fuel demand.

Brent crude dropped $40.46 barrels per day. WTI fell to $39.15 barrels per day. Benchmarks fell more than 3% on Tuesday as Covid-19 cases passed 1 million, which doubled in three months.

https://finance.yahoo.com/news/asia-stocks-drift-china-data-214101570.html