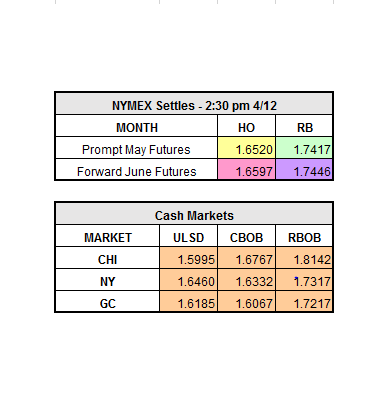

Yesterday the market stayed relatively quiet as we approach the holiday weekend. May HO closed up $0.0014 to $1.6520/gal, May RBOB closed down $0.0160 to $1.7417/gal, and WTI Crude closed down $0.29 to $53.11/bbl. It seems we are also in store for another calm day today with the market currently trading slightly down across the board. As of 11:22a.m. ET front month HO is down $0.0041 to $1.6479/gal and front month RBOB is down $0.0135 to $1.7282/gal.

Non-OPEC crude supply is much higher than last year at this time, leading to concern about oversupply in the market. According to IEA data, crude growth forecast is at 485,000 bpd worldwide in comparison to the decline of 790,000 bpd in 2016. Despite continued threats from OPEC and other producers about keeping supply cuts in place, these oversupply concerns are finally having an impact on today’s market. With evidence that OPEC is sticking to their commitments and considering extending their cuts, supply is still outweighing demand. Specifically, Saudi Arabia has stuck to their part of production cuts. Over the past 15 weeks US crude inventories have risen by 10% and prices of crude have increased by about 1.3% during this time. Crude inventories have fallen just below the all-time high after the draw in crude in the DOE reports yesterday.

An important item to note is that the market will be closed tomorrow for the holiday. Also, prices that suppliers send today, will be effective from 6 p.m. today until 5:59 p.m. on Monday April 17, 2017.