On August 16, 2022, President Biden signed the Inflation Reduction Act of 2022 (IRA), which takes effect on January 1, 2023, and resurrects the Hazardous Substance Superfund Trust Fund Tax (aka “Superfund” tax) on oil and petroleum products.

We want to make you aware of tax changes effective January 1, 2023, which will impact the prices that fuel users pay for diesel fuel and gasoline.

Some suppliers reflect the compliance cost as a “separate line item” on invoices. At the same time, other suppliers will include the cost of compliance as part of the posted product price and will not reflect any distinct line-item fees.

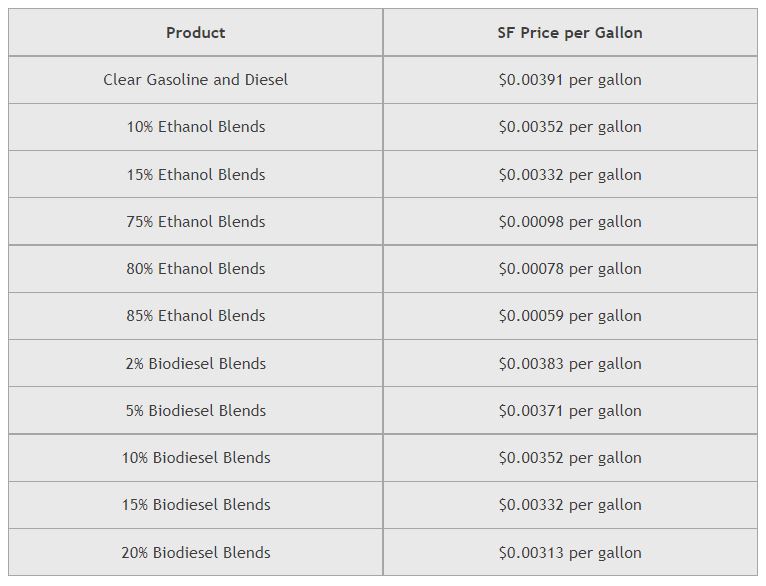

Therefore, beginning January 1, 2023, Guttman will invoice an additional line-item Federal Superfund Fee Recovery. For all gasoline and distillate-based products, the standard rate of $0.00391 per gallon will be charged. However, for products blended with ethanol or biodiesel, the following rates will apply:

If you have any questions or concerns, please contact your Guttman sales representative.

As always, we greatly value our relationships with you and remain committed to helping you achieve all your business goals and provide excellent service to your customers.

Thank you again for your support and business.

On behalf of the entire Guttman Energy team, we wish you safe and enjoyable holidays.

Best regards,

Guttman Energy